How Delta Exchange Simplifies Complex Crypto Derivatives Trading for Users

Crypto trading in India is a fast-evolving sector, if not the fastest. With over 120 million users expected in 2026, the market is moving beyond traditional trades and assets. It’s why crypto derivatives are popular now – they offer more flexibility, better risk management, and the potential for bigger profits.

But between margin requirements, expiry dates, and complex strategies, many platforms make things more complex than they need to be. This is where Delta Exchange makes a real difference.

From INR-based transactions to advanced trading tools, the Delta Exchange app makes crypto derivatives trading manageable and simpler for newcomers as well as experienced traders.

In this post, we’ll tell you all the reasons why Delta Exchange is among the leading choices for Indian users.

Delta Exchange at a Glance

Delta Exchange launched in 2018 with a clear focus – make crypto trading on F&O more accessible. It’s registered with the Financial Unit of India (FIU), which gives you some peace of mind around regulatory clarity.

Source | Delta Exchange for crypto derivatives trading

The platform consists of a wide range of crypto derivatives, including futures and options on major cryptocurrencies like BTC, ETH, and other altcoins. The Delta Exchange app brings everything together in a clean, responsive format for serious traders.

Key Features: Simplifying User Experience

Here are some key features to look for on Delta Exchange:

INR-based deposits and withdrawals

Delta Exchange supports direct INR deposits and withdrawals, which helps you skip the usual currency conversion hurdles. You don’t have to route through third-party platforms or lose money on hidden charges. If you’re just getting started with crypto F&O trading, this simple INR feature makes a big difference.

Clean and intuitive trading interface

The platform offers a smooth experience across both web and mobile. The Delta Exchange app gives easy access to charts, orders, and open positions, without confusing or overwhelming you. Whether you’re checking price swings or managing active trades, the layout feels natural. Dashboards can be adjusted based on how deep you want to go, which makes it useful for all levels of crypto derivatives traders.

Strategy and analytical tools

Delta Exchange’s strategy builder lets you create options strategies in a few simple steps – no coding required. For more control, basket orders allow you to group multiple trades into one execution. These tools are built to support structured trading setups, making crypto F&O trading more manageable for those looking to hedge or run multi-leg strategies on crypto derivatives.

Trading bots for automation

Delta Exchange offers trading bots for executing crypto F&O trading strategies on F&O automatically. These bots run 24/7, adjusting positions based on market conditions. You can generate buy and sell signals via Trading View and get notified through the Delta trading bot for automatic trade execution on the platform. It’s a useful tool to use without sitting in front of the screen and to avoid emotional trading.

Risk Management Features for Safer Trading

Delta Exchange builds safety into every part of the trading process in real time:

- Flexible leverage options: Use up to 100x leverage, with full control over position sizing. Though it carries significant risks, the potential for returns is also high.

- Stop-loss orders: You can lock in gains to maximize profits in case of unexpected market swings.

- Demo trading mode: You can practice crypto trading strategies on F&O and navigate the market without real money using Delta Exchange’s demo account.

- Multi-layer encryption: All user data and transaction details are encrypted across systems to maintain platform security.

- 24/7 support: Delta offers round-the-clock customer service through a ticket-based system to resolve queries quickly and efficiently.

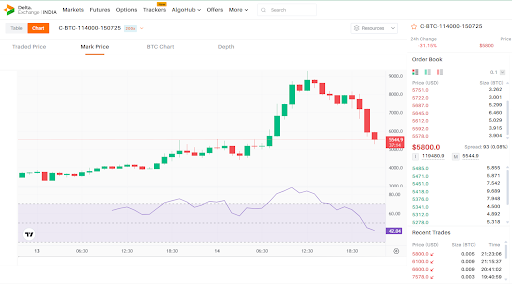

Product Variety and Deep Market Access

Delta Exchange offers a wide selection of crypto derivatives contracts, covering major assets like BTC, ETH, SOL, XRP, and more. You can choose between perpetual contracts and European-style options, depending on your strategy.

Source | BTC options trading

The platform supports deep in-the-money (ITM) and out-of-the-money (OTM) contracts, giving users flexibility based on their risk tolerance. With expiry choices ranging from daily, weekly to monthly, Delta Exchange makes it easier to match trades with specific market views. It’s one reason the platform ranks high among options for crypto F&O trading in India.

Start Trading on Delta Exchange

To start trading on Delta Exchange, follow these steps:

- Go to www.delta.exchange and sign up using your email ID.

- Complete your account setup by filling in personal and banking details as required.

- Add funds in INR through UPI or bank transfer.

- Explore available markets, including BTC, ETH, and other listed assets under crypto F&O trading.

- Place trades directly through the platform using the web interface or the Delta Exchange app.

- Withdraw profits in INR to your bank account anytime after completing KYC.

The platform is open 24/7, letting you trade crypto derivatives whenever the market moves.

Final Thoughts

Delta Exchange brings together useful tools like INR access, reading bots, demos account, and more – all things that matter when you’re exploring crypto F&O trading. It’s built with Indian users in mind and offers enough flexibility for both first-time traders and those who’ve been in the market longer. If you’re curious about trading crypto derivatives without overcomplicating the process, Delta might be a good place to begin with.

For more information, visit the website or join our community on X.