eToro Review: The Social Trading & Investment Platform

Although eToro is an essential player in the CFDs’ world and cryptocurrency trading, the company now offers much more than that. He has led the fintech Revolution for more than a decade and has established a reputation as an essential platform in the social trading world.

The company started as a global trading platform but has added cryptocurrency and more trading tools to keep up with diverse markets and increasing demand. They are committed to incorporating social features into their platform in the form of copy trading and copy portfolios.

Today, etoro has more than 6 million registered users, protecting its status as an industry leader. Read on for our complete review.

Risk Warning

CFDs are intricate devices having a high risk of wasting money speedily because of leverage. When dealing with CFDs with this source, 75% of retail investor accounts are lost, and you need to consider whether you realize how CFD works and whether you are at a higher risk of losing your money.

History of eToro

eToro was begun in 2007 by three entrepreneurs for those who wanted more accessible trading for all time users. Simultaneously, they needed to decrease dependency on banks and other traditional financial institutions. eToro initiated an online trading platform with graphs representing financial instruments and an intuitive interface.

In 2009, eToro launched the trading platform, WebTrader, with a range of professional tools for traders of all skill levels.

When trading CFDs with this provider, 75% of retail investor accounts are lost. You need to consider whether you can afford to take the risk of losing your money. With OpenBook, a big step forward was made in 2011, the world’s first social trading platform. It included a new copy trader feature of the time, which allows anyone to copy successful traders. In 2012, eToro added stocks to its other assets, such as currencies and commodities.

The eToro mobile app launched in 2013 for both Android and Apple, expanding the reach of the platform. This was also the case when eToro immersed itself in crypto, which makes it possible to trade bitcoin through CFD. In 2015, the platform updated the interface for an even more modern and intuitive experience.

In 2016, it added a copy portfolio, related departments that bundle different assets or top traders under a market strategy. In January 2017, eToro expanded its reach into the world of cryptocurrency by adding support for crypto trading to the platform. It started with a range of popular cryptocurrencies, including Ethereum, Litecoin, and XRP. In 2019, he launched eToroX, a full-fledged cryptocurrency exchange.

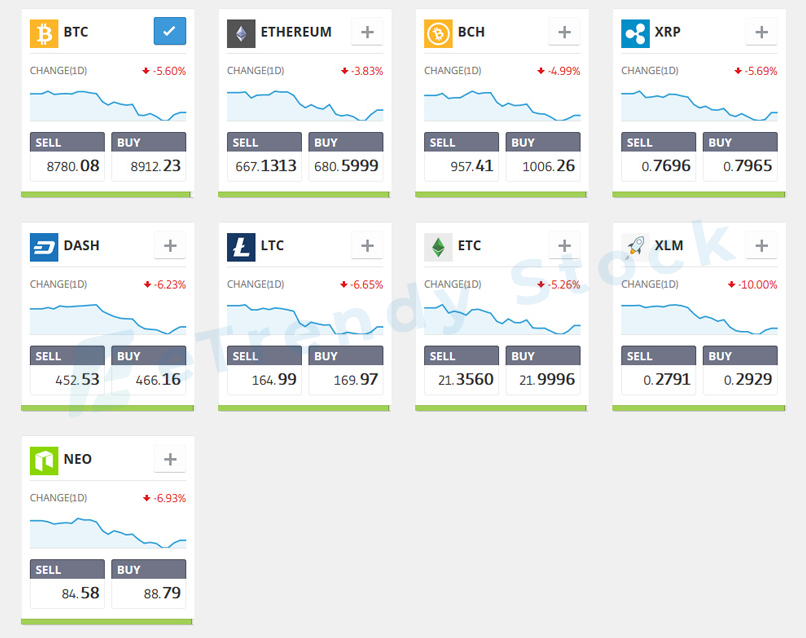

Cryptocurrencies supported by eToro

Compared to other platforms, the options for supported cryptocurrencies on eToro are comparatively restricted. This is a result of its nature as a global trading platform, which is opposed only to cryptocurrency. Even so, you can shorten or own popular cryptocurrencies. Supported options include Bitcoin, Ethereum, Bitcoin Cash, Ethereum Classic, Litecoin, and Ripple.

What sets eToro separately from other platforms?

The most significant way to stand out from other platforms is the sheer number of investment and trading options available. Thanks to the myriad of investing and trading, consumers can take advantage of the same platform for their cryptocurrency trading needs as traditional assets.

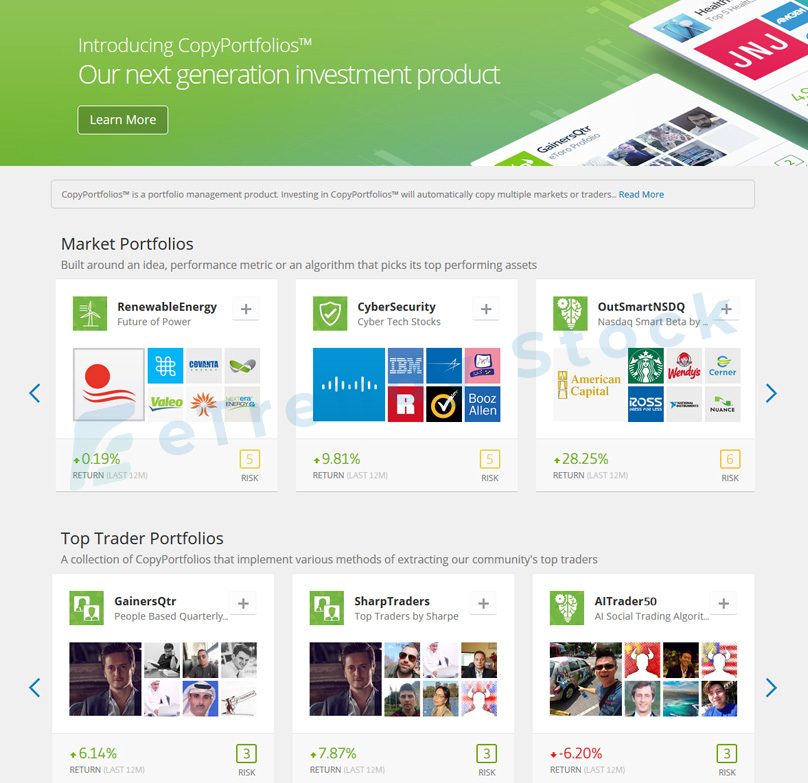

The social elements of eToro also make it unique. An example of this is copy portfolios, long-term thematic investment in the form of top traders with a well-organized portfolio bundling assets, and a default strategy. The ability of successful entrepreneurs to copy investments is also innovative, as is the Popular Investor Program.

Trading tools offered by eToro

The platform aims to educate entrepreneurs as well as provide them with a platform for investment. Upon enrollment, eToro customers receive “Virtual Money Accounts” with over 100,000,000 to work on strategies and skills before spending real money.

It also provides multiple tools to help with real trade, such as economic calendars. Trade the dates and time zones you want to see and the assets you trade. This calendar will then show you how events can affect your assets. Also, it provides regular market analysis that includes excellent details and quick reviews, so you can use more or less information than you need.

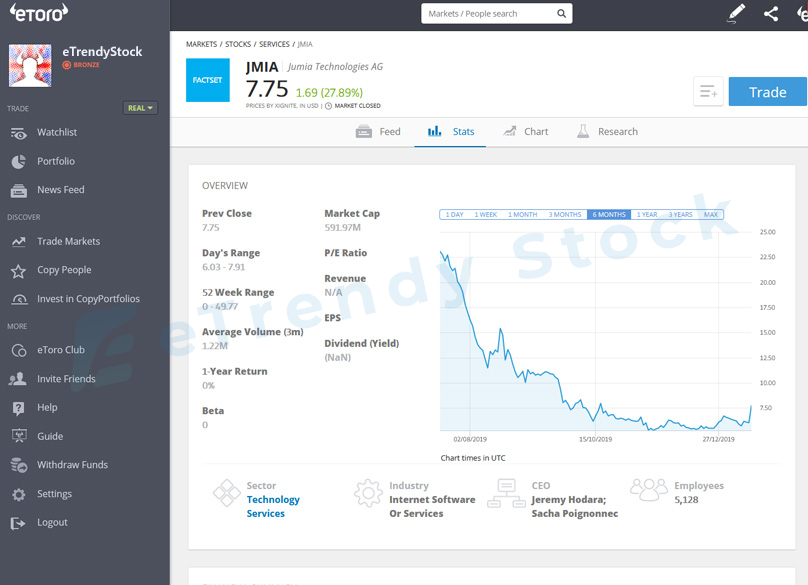

Each asset that is marketable on the platform has its page where you can view detailed information, news, charts, and research.

CFDs

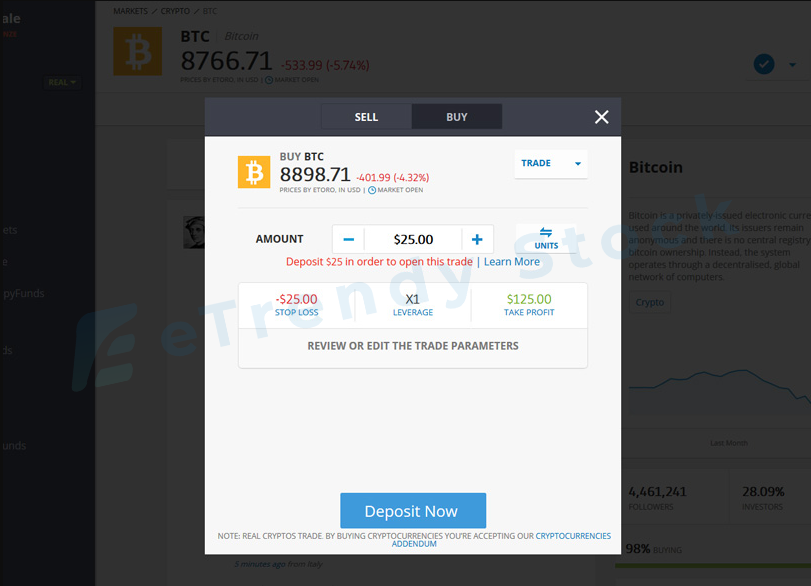

CFD, or difference agreement, is a type of derivative trade. Through the CFD, investors can speculate on whether the fast-moving global financial markets will rise or fall. This can be done with cryptocurrencies as well as indexes, shares, fiat currencies, treasuries, and commodities.

The critical thing to note about CFD trading is that you will not be buying or selling this asset, in this case, cryptocurrency. Instead, you sell or buy a certain number of units based on this prediction if the price will rise or fall based on your forecast.

When the device goes in your favor, you get a multiplication of the existing CFD units that you have already sold or purchased. You incur losses for every loss that is incurred against you. CFDs require caution as losses may exceed accumulated deposits.

On eToro, CFD trading and cryptocurrency go hand in hand. As mentioned earlier, eToro entered the world of cryptocurrency for the first time in 2013 by offering bitcoin trading through CFD, making it one of the first players in the world of cryptocurrency investing. ۔

CFD Trading continues to play a vital role in eToro as many of the trades involved in crypto are still CFDs instead of dealing with real assets.

Beginning September 3, 2017, those who have invested in a BUY position for crypto on eToro own the transaction’s internal assets. Before that, he held CFDs, not an asset. Besides, eToro offers first cryptocurrency trading. If you choose to open a short or sell position for cryptocurrencies on eToro, it is still in the CFD position.

Copy portfolios

Copy portfolios were added to the eToro platform last year. This feature is available for cryptocurrency trading as well as traditional fiat trading. It creates a viable asset that is made up of traders with carefully selected assets or predictive strategies.

The eToro Investment Committee compiles copy portfolios and balances them from time to time. There are many cryptocurrency copy portfolios available for investors to choose from.

One of them is simply called “cryptocurrency” and represents atrium and bitcoin. At the May 2017 cryptocurrency bull run, the fund grew 66%. Within the first three months, the fund increased its profits by more than 125%. Another option is called “CryptoCopy Portfolio.”

This is a recent copy portfolio with a balanced crypto portfolio, including Bitcoin, Ethereum, Ethereum Classic, Litecoin, Dash, and Ripple.

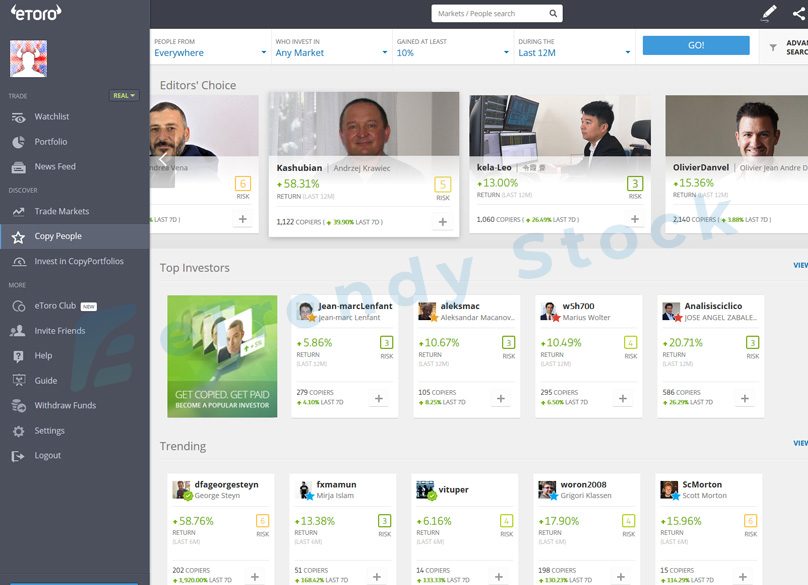

Copy-trading

Another exciting option on eToro that you can use for crypto and Fiat investing is copy trading. Copy trading is an innovation that allows users to view and copy the track records of other traders, which means they will mirror their trades. Entrepreneurs have the potential to become “popular investors” if they have low risk and a steady return.

They then receive rewards for sharing their knowledge. By taking advantage of copy trading and copying an investor that includes cryptocurrency in your portfolio, you can gain exposure to the market without much research.

Users of eToro

eToro can be used by anyone, as long as it is legal to do so in their country. eToro has an existing list of states where the platform is blocked due to changes in rules and regulations that conflict with trade rules. This means that people living in the United States, Canada, Cuba, Japan, North Korea, Iran, Syria, Turkey, Serbia, Albania, and Sudan cannot legally use eToro.

Does eToro have a minimum trade size?

eToro prides itself on offering tools that investors and traders of all levels of experience can benefit from, so it seeks to minimize trade usage. The minimum amount for manual positions is device-based. For currencies (such as cryptocurrencies) and commodities, it’s only $ 25. For stock, it’s $ 50. Finally, for ETFs and indexes, it’s 200.

For those who registered on or after April 2, 2017, the minimum trading volume depends on the exposure in the form of leverage times of the investment amount. For the cryptocurrencies, the minimum amount is $ 200. The minimum is 500 500 for ETFs and stocks, $ 2500 for commodities, and 000 5000 for index and forex. As an example of this exposure policy, if you open a corrupt trade with X1 leverage, you must invest at least 200. If, however, you choose to spend ڈالر 100, you must have at least x2.

eToro fees

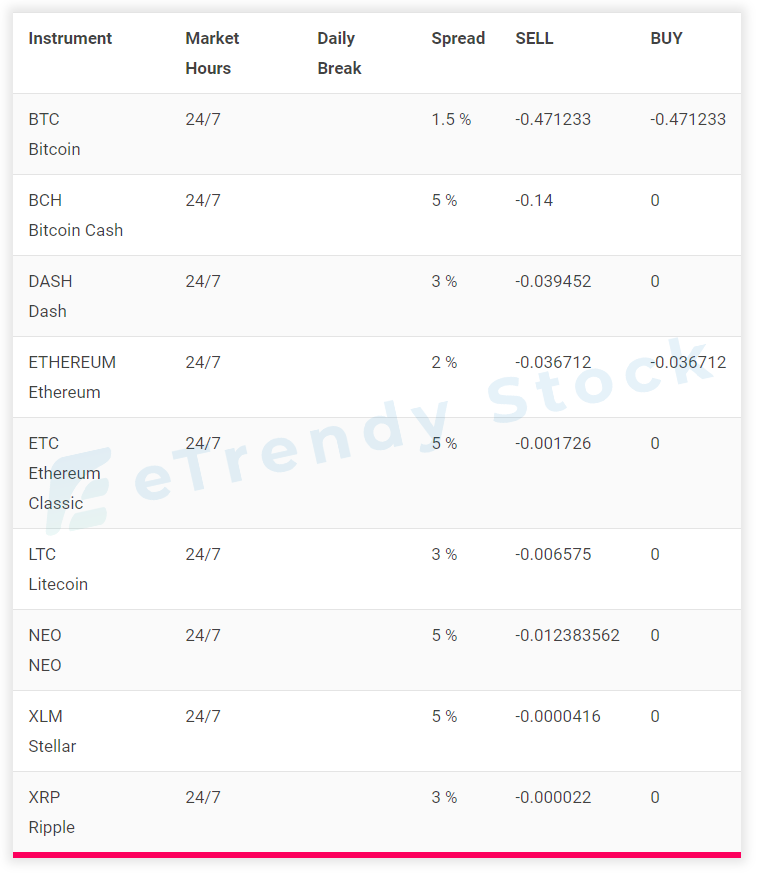

In Exchange, eToro receives its profits from the various fees it collects. On eToro, there is no charge for opening a position, instead of a spread-based price. It has a list of minimum spreads for each cryptocurrency, and these rates are not guaranteed. The team says spreads can vary depending on liquidity and market conditions.

The spreads of daily break are as follows: 1.5% for BTC, 5% for BCH, 3% for DASH, 2% for Ethereum, 5% for ETC, LTC 3% for, 5% for CEO, 5% for XLM, and 3% for XRP.

Due to the nature of cryptocurrency trading, it is available 24/7, and there is no fee for overnight or weekend trading. Instead, Etoro charges only for users who hold a leveraged Ethereum or BTC position or shorten cryptocurrencies. The team explains that there is a change in the different fees.

eToro customer reviews and credentials

Users and reviewers of the platform generally agree that eToro is very easy to use. It was designed to be intuitive so that people with no business experience could access their information and trade.

You can use the platform on PC, Mac, Android, or iOS devices, always taking advantage of its intuitive functionality and quickly displaying cryptocurrencies and other assets through graphs.

In general, eToro has a good reputation online. The company is big and well established so you can be sure that your funds are safe there. Complaints from people online are usually about traders whose performance they thought they would copy as well as copy.

This is not the fault of the traders themselves. Trade is a complicated business as everyone has advantages as well as disadvantages. Other issues revolve around the fact that eToro has advertised so much that you can buy crypto with them when you do not own the assets. This is the same for all such brokers if you want to own physically corrupt assets you will need to buy them on an exchange that can offer it, such as bonds.

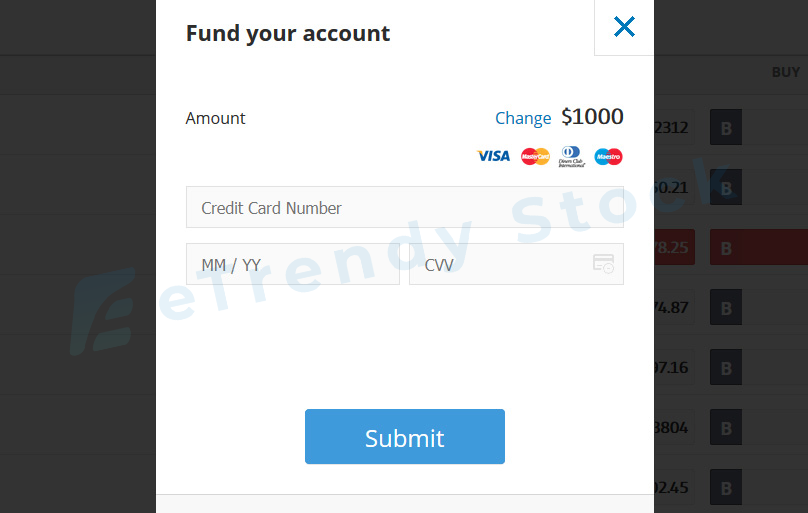

Raise and deposit money on eToro

There are several ways to collect for eToro, so you can choose what best suits your needs. You can choose to submit via wire transfer, bank transfer, Visa, MasterCard, NETELLER, PayPal, Yandex, WebMoney U.K., Scroll, and others.

To withdraw, you will need to fill out a form and then usually receive the payment via PayPal, bank transfer, or your credit or debit card. To withdraw, you will need a copy of your signature, a color passport copy, and proof of address.

Cryptocurrency expansion

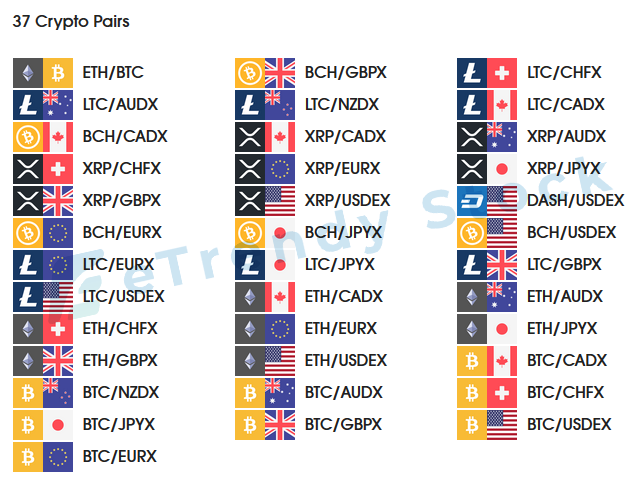

eToro has recently added about 35 new fit pairs to its platform, with a total of about 44 pairs of pairs for its customers. The new pair covers a wide range of regions and currencies, targeting people from countries such as Canada, Australia, and Japan. The updated pairs are as follows:

- Australia BTC / AUD, ETH / AUD, XRP / AUD, ETC / AUD, BCH / AUD, LTC / AUD,

- Canada BTC / CAD, ETH / CAD, XRP / CAD, ETC / CAD, BCH / CAD, LTC / CAD

- Japan ETC / JPY, BCH / JPY, LTC / JPY

- New Zealand BTC / NZD, BCH / NZD, ETH / NZD, ETC / NZD, LTC / NZD XRP / NZD

- Switzerland BTC / CHF, ETH / CHF, XRP / CHF, LTC / CHF, BCH / CHF, ETC / CHF

- UK BCH / GBP, ETC / GBP, LTC / GBP, XRP / GBP

- EU BCH / EUR, ETC / EUR, LTC / EUR, XRP / EUR

Besides, eToro has officially announced a cryptocurrency focus trading platform aimed at U.S. consumers, as well as a crypto wallet, and an integrated mobile app that allows credit card purchases via credit card.

The service was unveiled in May and enabled U.S. consumers in 32 states and territories to trade a growing number of different cryptocurrencies, including accessible assets such as Bitcoin (BTC), Ethereum (E.T.). H), Litecoin (LTC), XRP, Dash (DASH), NEO, and EOS.

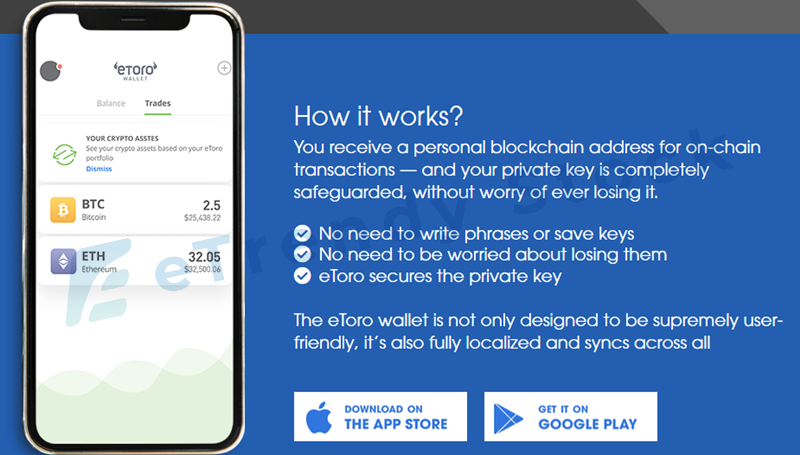

The team also announced that their cryptocurrency mobile wallet had been made available to iOS and Android device users. Existing eToro users can log in directly to the portfolio to transact and store cryptocurrencies. At the same time, with a few clicks, it is possible to change the wallet asset, moreover, funds by sharing the wallet address. It can be received and used by Q.R. codes.

eToro Wallet allows users to:

- Manage and store multiple cryptocurrencies

- Exchange for crypto-crypto

- Transfer crypto from their eToro accounts

Buy crypto with a credit card

eToro customers can also buy cryptocurrencies directly from eToro Wallet using a credit card. The investment platform has partnered with leading third-party payment provider Simplex, allowing e-Euro to integrate Visa and MasterCard payments.

Here’s how to buy some cryptocurrency using your credit card:

- Open your eToro wallet

- Click on the “Purchase CRYPTO” section of the wallet and select the coin and amount of your choice that you want to purchase.

- Enter your payment details in Simplex’s billing form.

- Upon successful completion of the process, your purchased coins will be transferred to your eToro wallet.

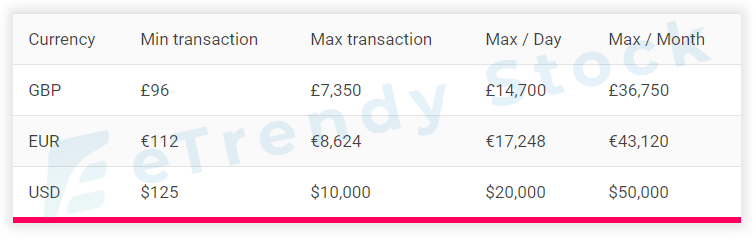

It is important to note that Simplex may choose to approve or reject your application immediately and request further documentation or proof of identity. These may include government-issued documents or selfies. This service is also subject to the following fees and limitations.

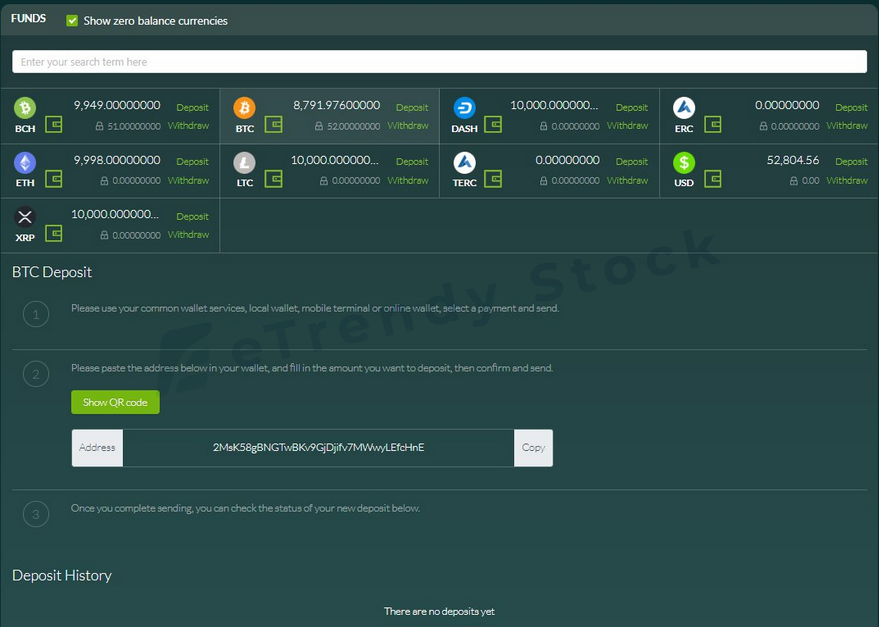

eToro Wallet Fee

Fight to a crypto conversion fee

- eToro’s Fee 1

- Simplex fee four ٪

eToro X determines the actual market rate once Simplex approves the transaction, and in addition to the above fees, blockchain fees are deducted from the purchasing crypto and apply to every crypto transaction.

It is important to note that the charges levied by your bank or credit card issuer may result in additional charges. These may include cash advance or foreign transaction fees on your card transactions. Any transaction will appear on your credit card or banking statement as eToro LTD, including Credit Card Descriptor Simplex Torrox. Yes, however, a confirmation email will also be sent.

Any pending payment can be canceled, advising customers to open the ticket directly on the Simplex website or to use the live chat feature at the bottom right of the Simplex.com website.

It is also important to note that once a payment is approved, it cannot be canceled. Simplex handles the approval process, and as a result, questions about the transaction process should be sent to the Simplex customer service team first. However, the eToro customer service team is also available to deal with any issues.

eToroX Review

eToroX, the blockchain subsidiary of eToro’s more traditional investing platform has been formally launched in Gibraltar, a blockchain subsidiary, and is being regularized by the Gibraltar Financial Services Commission (GFSC). The Exchange aims to cater to skilled crypto traders and add many of the features found on their social trading platforms.

Crypto to Crypto Exchange includes an intuitive user interface. This mobile wallet app is regulatory, and uses state-of-the-art security protocols, and aims to provide better trading options for crypto fans across multiple regions.

The platform was originally launched with a limited number of cryptocurrencies. However, it currently has 16 digital assets and 37 Fiat pairs from cryptocurrencies available, and eToroX has also added eight branded stable coins that allow merchants without any hassle. Allow yourself to protect yourself from market fluctuations. “Cash out” at high speed.

eToro branded tokens that have marked Fight currencies include the eToro United States Dollar (USDEX), eToro Japanese Yen (JPYX), eToro Euro (EERX), and eToro Pound Sterling (GPB). X), eToro Australian Dollar (ADDX), eToro Canadian Dollar (included) CADX), eToro New Zealand Dollar (NZDX), and eToro Swiss Franc (CHFX).

Exchange Fees and Limits

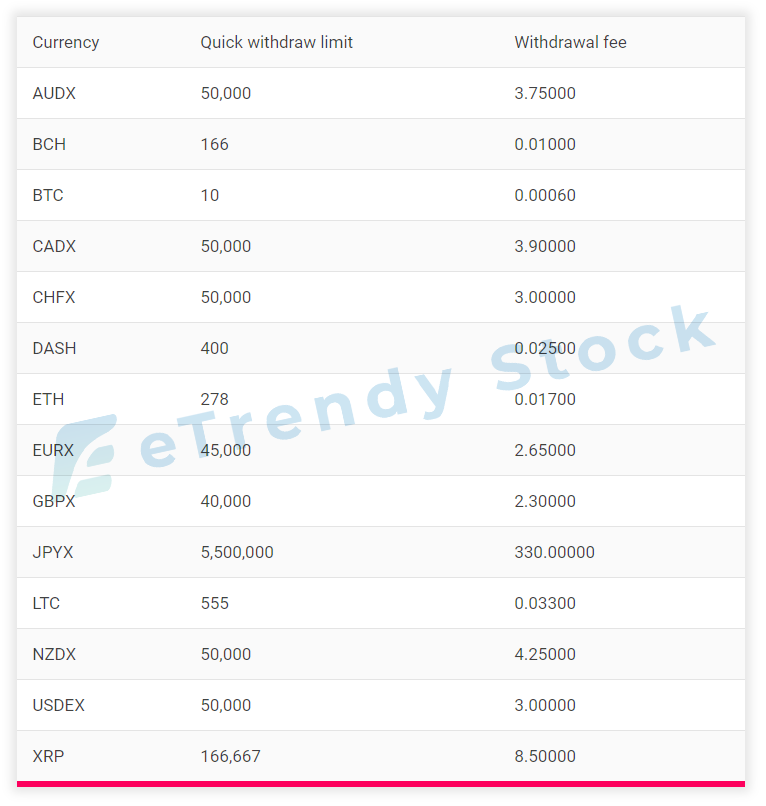

eToroX doesn’t charge for deposits, and withdrawal fees are as follows

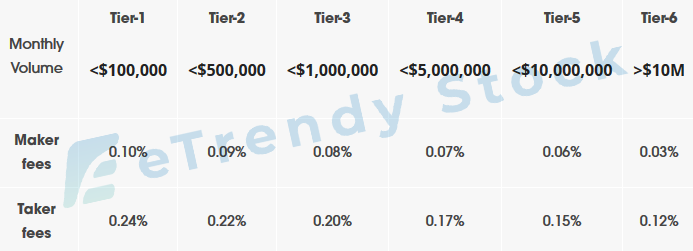

The Exchange uses a tiered approach to trading fees, and all transaction fees (under a monthly volume of 100,000) are calculated according to Tier 1. When the monthly trading volume exceeds Tier 1 (over $ 100,000), the discount is applied during the first week of the month. Depending on the level, the discount is calculated based on the percentage in the table below. Will be done

- Calculations will be made in each calendar month.

- Discount will be given in ETH

- The refund will be provided during the first week of the month.

eToroX also includes maker and taker fees. The former is compensated for trades where maker orders place the liquid in the Exchange, while taker orders remove the order book’s liquidity and Take care of their expenses.

As a result, maker fees are lower because of these orders, which help keep conversions liquid. An example of a maker trader order involves placing an order for a pending process, such as a limit order that is not automatically (partially or fully) filled.

This process helps to “create” the market and add liquidity to the order book, while a tacker order can take the form of an immediate order that does not go to the order book, such as for partial or fulfilled. This type of activity “takes” liquidity from the order book.

How secure is eToroX?

The Exchange includes several cutting-edge security protocols, including data encryption, by default, using a dedicated secure mechanism to prevent CSRF attacks.

Also, the team has developed its backlog analytics methodology based on the N.N. The machine-learning algorithm that assists in decision making includes numerous P.T. and code reviews as well as the Big Grace program. User accounts are made more secure because all eToroX users must complete Level 3 identity verification, and a double-digit check is required to update financial account information.

How secure is eToroX?

The Exchange includes several advanced security protocols, including default data encryption, using a dedicated secure mechanism to prevent CSRF attacks.

Besides, the team has developed its backlog analytics methodology based on NNN. Machine learning algorithms help with decision making, numerous P.T. and code reviews, and the Big Grace program.

The user’s account is made more secure because all eToroX users must complete Level 3 identification verification, and double-digit verification is required to update their financial account information.

On top of that, eToro has been working since 2007 and has established regular entities in Cyprus, the United Kingdom, the United States, Australia, and South Africa, with Gibraltar becoming its sixth jurisdiction.

The Government of Gibraltar and the Gibraltar Financial Services Commission (GFSC) have agreed to cover distributed ledger technology (DLT) businesses, and eToroX operates under the GTSC-managed framework.

The company is more transparent in the field of cryptocurrency. etoro X Limited is a limited liability company with registration number 116348 in Gibraltar and has a registered office at 57/63 Line Wall Road, Gibraltar.

GSFC has selected the company as a Distributed Ledger Technology Provider under the Financial Services (Investment and Fiduciary Services) Act. Its license number is FSC 1333B.

Account Verification

Gibraltar’s regulatory requirements ensure that each new account must be verified as part of the registration process, and the Exchange aims to make the verification process as easy as possible.

Is eToro safe?

To give users peace of mind, eToro takes steps to provide security. The company as a whole is fully regulated and adheres to the FCA and CESC guidelines. To help entrepreneurs make responsible decisions, it offers a variety of tools for all levels of experience, such as first-step guidance and risk management features.

eToro also takes precautions to ensure that users’ funds and personal information are protected. Traditional funds are kept in listed European 1 European banks.

With all of this in mind, you should keep in mind that there are no rules for cryptocurrencies. Because of this, if you are involved in cryptocurrency trading or other cryptocurrency-related investments, there will be no insurance from investor compensation schemes in the U.K. or Cyprus.

Lack of regulations also means that if you have a complaint, you cannot file it with your financial ombudsman services. Nevertheless, eToro takes pride in working to resolve issues seamlessly. Besides, there are many social platforms where you can file complaints, which can affect other users.

Conclusion

Although eToro focuses on more than just cryptocurrency trading, it is a useful platform for those who invest or trade in cryptocurrencies. Additional features of the eToro are what give it an edge, such as copy portfolios and various graphs. The platform is also very intuitive, something that everyone will love.

While eToro may not be ideal if you want to trade less popular cryptocurrencies, it is an excellent option for those who only care about the big ones or who use the same platform for both Fiat and crypto trading.

It is an excellent platform for regular stock and forex trading or just invests in pre-built departments in various industries.

This review was updated with the launch of eToroX. Now cryptocurrency investors can buy and hold cryptocurrency assets directly. This is a massive addition to the platform and now positions them well in space. We’ve been using eToro for years now, and with no hassle, deposits, and returns are processed quickly and reliably, so you need to worry about protecting your funds. eToro has proven itself reliable in the industry for many years and highly recommends that you test them.

The post eToro Review: The Social Trading & Investment Platform appeared first on eTrendyStock.com