The Future of Crypto Derivatives in India: Opportunities, Challenges, and Delta Exchange’s Role

The crypto market in India, already a fast moving one since its inception, is still evolving rapidly – and crypto derivatives are playing a major role in this transformation. As the number of crypto traders and their levels of sophistication grow, we find that derivatives like futures, options, and perpetual swaps are no longer being accessed only by institutional players. Retail investors, high-frequency traders, and hedgers are all tapping into these financial instruments.

There is immense potential in India’s crypto derivatives space, along with equally unique challenges – regulatory, technical, and educational. The arena is a complex one, but one crypto derivatives trading platform is making its presence felt with a product-first and compliance-led approach – Delta Exchange.

In this article, let us take a look at what the future holds for crypto derivatives in India – and how Delta Exchange is helping to make it shine.

What Are Crypto Derivatives, and Why Do They Matter?

Source | Investments in crypto derivatives.

Crypto derivatives are financial contracts that get their value from an underlying cryptocurrency asset. Instead of buying digital assets like Bitcoin and Ethereum directly, crypto traders speculate on their price movements through contracts like:

- Futures – Agreements to buy/sell at a predetermined future date & price.

- Perpetual swaps – Similar to futures but with no expiration date.

- Options – Contracts that offer the right (but not obligation) to buy/sell at a price that is predetermined.

Modern-day traders use these instruments to apply strategies such as hedging, leveraged speculation, volatility plays, and capital efficiency.

The growing awareness and availability of such products in India have led to tremendous growth in the demand for them. Moreover, as uncertainty looms large over traditional markets, crypto derivatives offer new opportunities for the alpha generation.

Opportunities in the Indian Crypto Derivatives Market

According to The Economic Times, digital payment transactions in India increased from 2,071 crore in FY 2017-18 to 18,737 crore in 2023-24, marking a CAGR of 44%.

India ranks amongst the highest globally when it comes to crypto adoption, thanks to its large tech-savvy populace and increasing digitization of finance. For the derivatives segment, this offers several tailwinds:

- INR-Centric Trading

Delta Exchange is one of the few platforms that offers crypto trading directly in INR – this does away with the cumbersome need to first convert to stablecoins like USDT. This simplifies onboarding, reduces fees, and makes tracking profit/loss much easier for Indian crypto traders.

- Regulatory Momentum

Crypto derivatives trading platforms like Delta Exchange, which are registered with India’s Financial Intelligence Unit (FIU), make the path towards legitimacy much clearer. Both institutional and retail traders can now confidently use compliant platforms that sit right with Indian regulators.

- Growing Demand for Advanced Tools

With an increasing number of retail crypto traders moving upwards from simple buy-and-hold strategies, there is an equal uptick in appetite for more sophisticated instruments. Think Options Combos, MOVE contracts, and multi-leg strategies – all available on Delta Exchange.

- Financial Inclusion and Youth Participation

India’s youth is mobile-first and increasingly digitally literate. Crypto derivatives trading platforms like Delta Exchange, which offer easy-to-use apps and strategy builders, are allowing for much higher participation rates.

For mobile trading, download the Delta Exchange app on Google Play or the App Store.

Challenges That Need Addressing

The future is indeed promising, but not without hurdles. The Indian crypto derivatives market faces several challenges that it must surmount:

- Regulatory Uncertainty

Despite the presence of the FIU and its regulations, crypto regulation in India is still far from comprehensive. This state of affairs naturally makes for institutions that are hesitant and product innovation that is limited.

- Risk of Misuse and High Leverage

Source | Leverage wipes out retail trader’s investments in crypto derivatives.

The use of leverage and crypto derivatives trading walk hand-in-hand, and traders who are not properly conversant in this matter can suffer substantial losses. Retail investors in particular are prone to misunderstanding the complexities of options or perpetual swaps.

- Banking Infrastructure Limitations

Platforms that serve as on-ramps and off-ramps face routine disruptions. For INR-based trading to thrive, integration with the banking system must improve.

- Global Competition

Major players like Binance and OKX are keeping a keen eye on India. Local crypto derivatives trading platforms need to compete not just on features, but also when it comes to trust, transparency, and regulatory alignment.

How Delta Exchange Is Shaping the Future

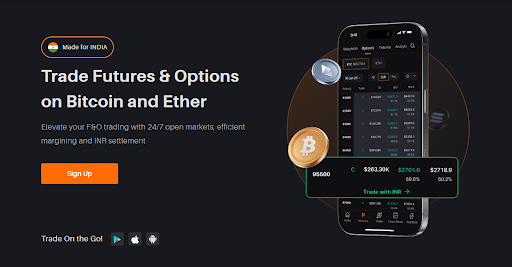

Source | Delta Exchange: An INR-first and regulatory-compliant crypto derivatives trading platform.

The ecosystem is evolving at a tremendous pace, and Delta Exchange is positioning itself as more than just another crypto derivatives trading platform – it’s fast becoming a launchpad for the next generation of Indian crypto traders.

Here’s how:

Regulatory First, Innovation Always

Delta Exchange is one of the few Indian crypto exchange registered with the FIU – demonstrating a rare commitment to compliance and KYC/AML. This gives it credibility with users and also bodes well for its compliance with upcoming regulatory developments.

A Full Suite of Derivatives

Delta Exchange isn’t just offering futures on Bitcoin or Ethereum. This crypto derivatives trading platform has one of the most diverse sets of offerings in India, with:

- Perpetual swaps across major and alt tokens

- Options trading for BTC, ETH, and more

This makes it a one-stop shop for advanced crypto trading in India.

INR-First Trading Model

The INR-first model of this crypto derivatives trading platform makes it extremely accessible and encourages participation. Crypto traders can deposit INR directly, trade without having to convert to crypto/stablecoins, and withdraw profits in INR.

Professional-Grade Infrastructure

Delta Exchange offers deep liquidity, fast execution, and minimal slippage – giving it the ability to cater to retail crypto traders, institutions, and high-frequency trading firms alike. It delivers on both fronts – an experience that is institutional-grade, as well as fantastic accessibility.

Security and Transparency

User security is top-tier, with:

- Cold wallet storage of funds

- 2FA for account safety

- Manual withdrawal checks for added protection

Education and Risk Management

Delta Exchange helps crypto traders learn the ropes without risking real capital through its risk-free demo mode. Used in conjunction with its strategy builder tools and advanced charting features, it enables users to make informed decisions.

What Lies Ahead: Trends to Watch

In India, as regulations develop and mature, and institutional interest grows, expect the following trends to shape the future:

- Structured products and custom strategies gaining popularity

- Regulated crypto ETFs possibly paving the way for broader exposure

- AI-driven trading pools integrated into retail platforms

- Deeper institutional participation from hedge funds and asset managers

- Delta Exchange expanding its educational offerings and global footprint

To Sum Up

The future of crypto derivatives in India holds tremendous promise. As the market matures, there’s a clear need for platforms that offer innovation, accessibility, and regulatory alignment.

Delta Exchange isn’t just meeting this need – it’s defining it. With a robust suite of products, INR-first trading experience, FIU registration, and a focus on trader education, Delta is powering the next wave of Indian crypto adoption.

For anyone looking to explore the high-potential world of crypto derivatives with the right mix of safety, sophistication, and support, Delta Exchange is a name to watch – and a platform to trust.

Disclaimer: Cryptocurrency trading involves a high degree of risk and may not be suitable for all investors. Prices are very volatile and subject to market risks. Readers are advised to carry out their own research and consult licensed financial advisors before making any investment decisions. Delta Exchange operates in compliance with applicable Indian regulations and is registered with the Financial Intelligence Unit (FIU) of India.