The Rise of Crypto Derivatives in India: A Strategic Advantage for Traders with Delta Exchange

The crypto market has evolved far beyond the traditional buy-and-hold trading strategy. Today, advanced trading tools like crypto derivatives have taken center stage, allowing traders to speculate on price movements without directly owning the digital assets. In India, the crypto derivatives market is no longer just for experienced traders; it is also attracting newcomers and retail investors who are keen to diversify their crypto portfolios.

Source | Delta Exchange for crypto derivatives trading

As the demand for these advanced trading tools grows, platforms like Delta Exchange are stepping up to meet the needs of the market.

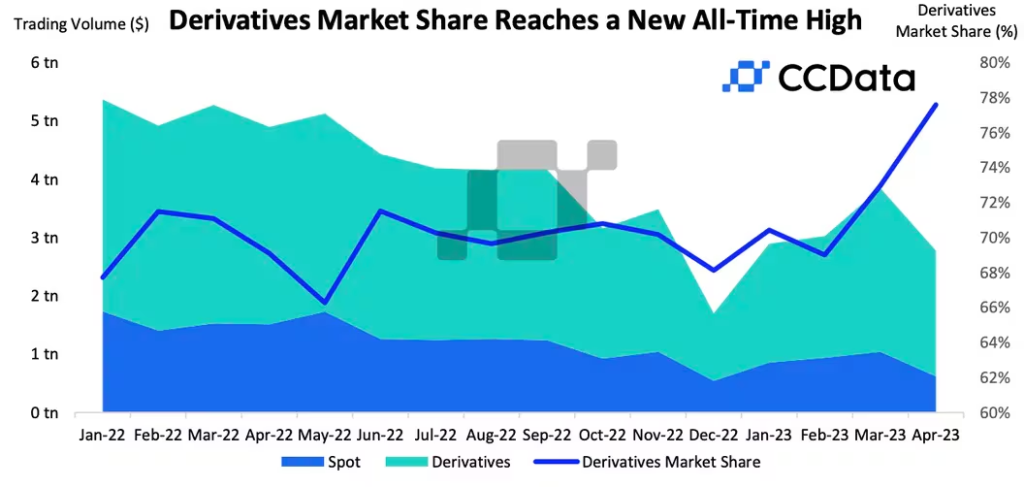

According to CCData, crypto derivatives trading reached a record of around 78% of all volume last year, even as absolute derivatives trading volume slid 23.3% to $2.15 trillion.

Source | Crypto derivatives market share

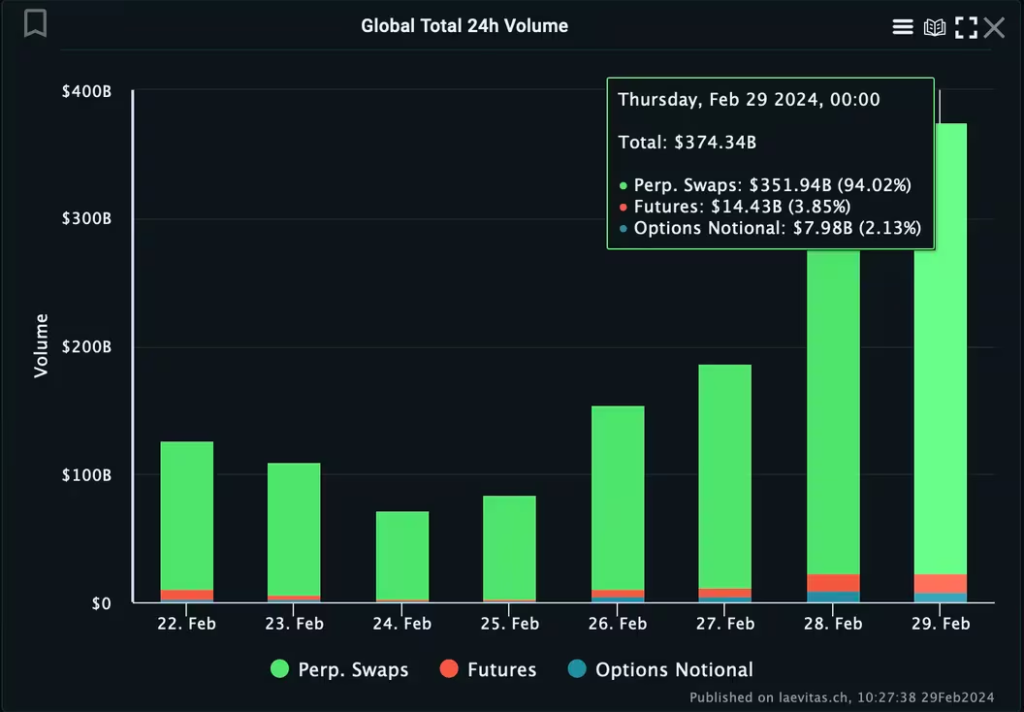

Another report by CoinDesk from February 2024 states that global Bitcoin (BTC) derivatives trading increased to a staggering $374 billion in crypto futures, perpetual futures, and options contracts in just 24 hours, the highest since November 2021. This surge clearly indicates the growing demand for crypto derivatives in the market.

Source | BTC derivatives trading volume

With its vast tech-savvy population and crypto enthusiasts, crypto derivatives trading is on the rise in India, and traders are finding ways to extract all benefits from the crypto market.

In this blog, we will explore how crypto derivatives trading can be beneficial to traders in the Indian market.

First, a Quick Brief on Crypto Derivatives

Crypto derivatives are similar to traditional derivatives, where a seller and a buyer enter into a financial contract to sell or purchase an underlying asset. These digital assets are sold at a predetermined price and time, and their value depends on the underlying crypto asset.

There are four main types of crypto derivatives: options, futures, perpetual contracts, and swaps. These provide traders with tools to hedge against their current assets and maximize returns through leverage.

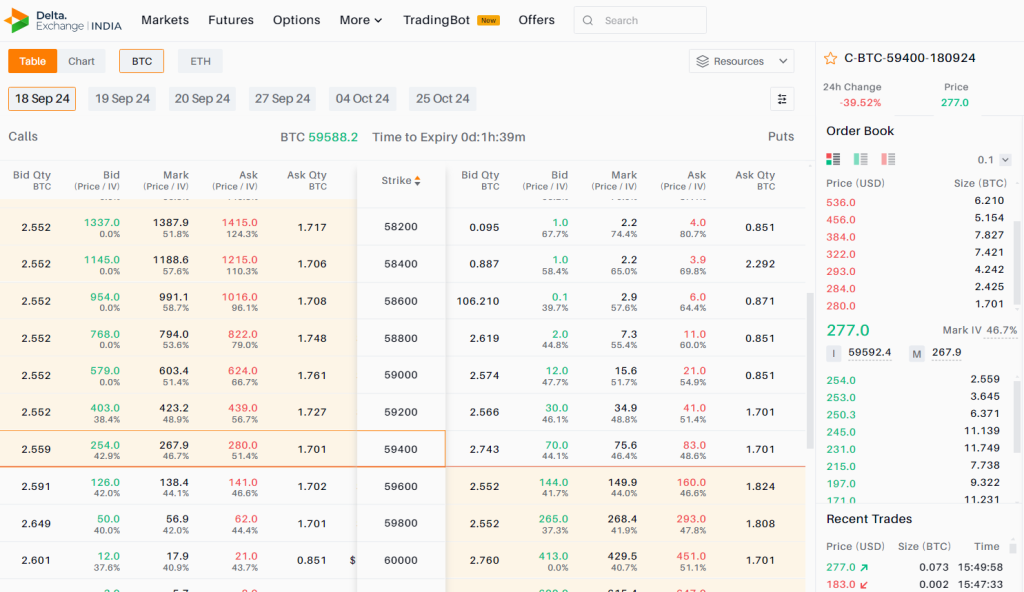

Financial contracts, especially futures and options, are traded on cryptocurrency exchanges like Delta Exchange, which provides a secure trading environment for Indian traders.

Source | Options trading on Delta Exchange

WEEKLY SNAPSHOT ON STRADDLE PREMIUM – DELTA EXCHANGE

| Weekly Returns (20 Dec – 26 Dec) | |||||

| Underlying | Weekly High ($) | Weekly Low ($) | Last Price($) | % Change since Last Week | Intraday ATM Straddle Premium for Friday (24 hr to Expiry) |

| BTCUSD | 99949 | 92485 | 95750 | -1.73% | 2320 |

| ETHUSD | 3553 | 3100 | 3333 | -2.44% | 117 |

Note: Last Price mentioned as on 26 Dec, 11:59 PM

| Straddle Premium Comparison | ||

| Underlying | Previous Week

(Exp 27-12-2024) |

Upcoming Week

(Exp 03-01-2025) |

| BTCUSD | 6100 | 6160 |

| ETHUSD | 310 | 280 |

| Altcoins Futures Watch Past Week (20 Dec – 26 Dec) – Delta Exchange | ||||

| Alt Coins | Weekly High | Weekly Low | Last Price | % Change |

| FTMUSD | 1.09900 | 0.84440 | 0.87180 | -12.53% |

| AAVEUSD | 390.068 | 271.450 | 337.544 | 7.25% |

| BNBUSD | 720.020 | 618.000 | 688.880 | 3.42% |

Note: Last Price mentioned as on 26 Dec, 11:59 PM

Getting Started on Delta Exchange

Here’s how traders and investors can begin their crypto derivatives trading journey on the Delta Exchange platform. First, register and sign up using all the personal, KYC, and bank details. After successful registration, one can handle all the transactions smoothly.

For deposits:

- Log in to your Delta Exchange account

- Go to the ‘Add funds’ section

- Add accurate bank account details

- Once whitelisted by the team, traders can transfer funds to their accounts.

For withdrawals:

- Log in to your Delta Exchange account

- Go to the ‘Withdrawal’ section

- Specify withdrawal amount

- Add proper bank account details

- Confirm withdrawal by transferring the selected amount.

Traders and investors can easily manage funds on the platform in an efficient and hassle-free manner by following the above steps.

Download the Delta Exchange app from the Google Play Store or App Store to begin crypto derivatives trading.

Key Advantages for Traders

Trading crypto derivatives on Delta Exchange offers several benefits to traders and investors:

Hedging

Hedging is a major benefit for traders. They can trade bitcoin futures and options to protect themselves against price fluctuations and loss. For instance, if a trader holds BTC but is afraid of a short-term price drop, they can sell BTC futures to hedge their position.

Leverage

Leverage allows traders to open large positions with minimal capital investment. On Delta Exchange, where leverage ratios are high, traders can maximize their potential gains. However, it also increases the risk of losses.

Price Speculation

For investors and traders who thrive on crypto market volatility, derivatives offer the perfect opportunity for speculation. Traders can bet on trending and dipping markets, opening long or short positions as needed. This strategy helps them profit from price movements regardless of market shifts.

In addition to these benefits, Delta Exchange, with its 24/7/365 open market, multiple expiries, advanced charting tools, and high liquidity, provides the necessary instruments needed for Indian traders to engage in the market.

These are the key reasons why traders and investors are increasingly turning to crypto derivatives trading strategies. These strategies help traders assess and manage risks and capitalize on market opportunities.

The Bottomline

Indian traders are seizing the opportunity to maximize their profits in the rapidly growing crypto derivatives market. With a total trading volume of ₹13.7KCr ($1.6B) in just 24 hours (at the time of writing), Delta Exchange has become one of the most secure, trusted, and reliable exchange platforms catering to the Indian audience. Hedging, speculation, leverage, and several advantages offered by the Delta Exchange attract more traders and investors to the ecosystem, positioning India as one of the global leaders in crypto adoption.

About Delta Exchange

Delta Exchange has developed a crypto derivatives trading platform exclusively tailored for the Indian audience. It delivers on its promises, shaping a favorable future for cryptocurrency in India and attracting more traders to the platform.

To understand more details, visit the website or connect on X and Instagram.

Disclaimer: Cryptocurrencies are inherently volatile, and investments in the asset class can carry significant risks. The information presented in this article is not intended to be financial advice, and we strongly recommend conducting your due diligence before investing in crypto.